Global Commercial Aircraft Landing Gear Industry: Key Statistics and Insights in 2024-2032

Summary:

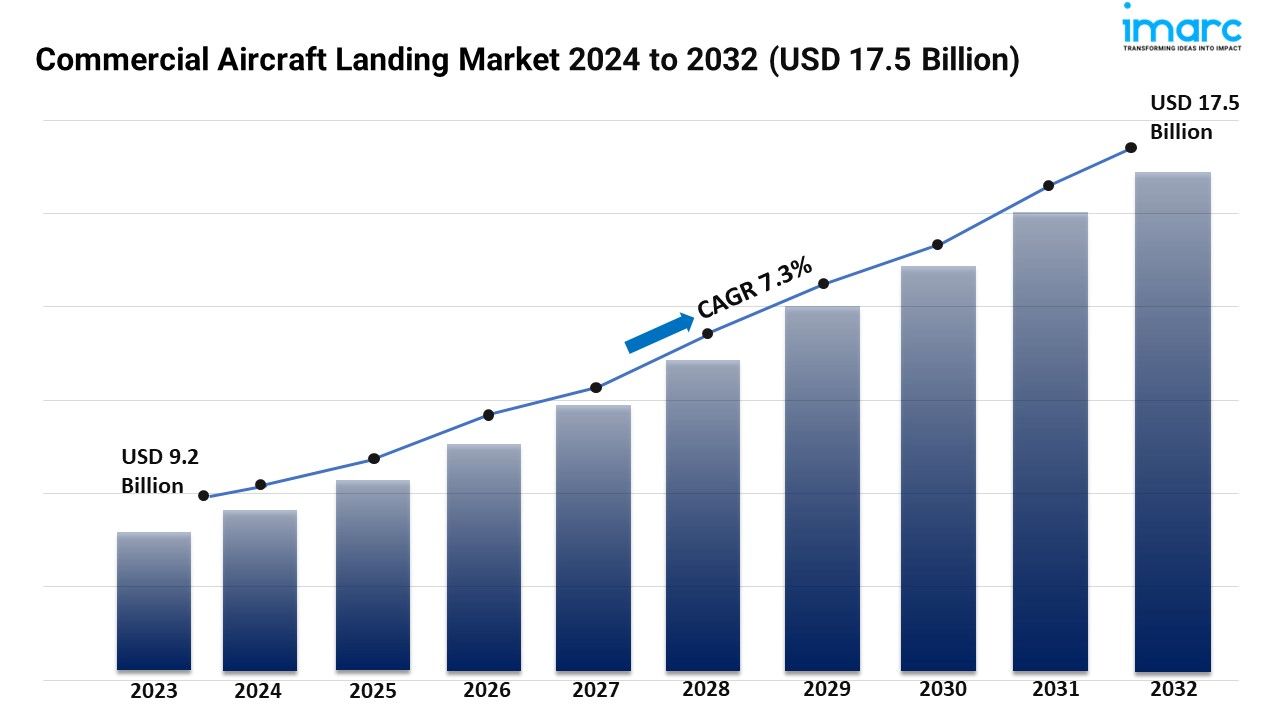

- The global commercial aircraft landing gear market size reached USD 9.2 Billion in 2023.

- The market is expected to reach USD 17.5 Billion by 2032, exhibiting a growth rate (CAGR) of 7.3% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest commercial aircraft landing gear market share.

- Narrow-body holds the majority of the market share in the aircraft type segment.

- Main landing gear dominates the commercial aircraft landing gear industry.

- Tricycle represents the biggest arrangement type segment.

- The rising shift towards lightweight and advanced materials is a primary driver of the commercial aircraft landing gear market.

- Advancements in automation and smart landing gear technology and the emphasis on maintenance, repair, and overhaul (MRO) services are reshaping the commercial aircraft landing gear market.

Industry Trends and Drivers:

- Growing shift towards lightweight and advanced materials:

The industry-wide shift towards using lightweight and advanced materials in aircraft manufacturing represents one of the key factors impelling the market growth. Aircraft manufacturers are focusing on enhancing fuel efficiency and reducing overall carbon emissions, which is encouraging the adoption of materials like composites, titanium alloys, and other advanced metals in landing gear systems. These materials not only reduce the weight of landing gear components but also provide superior corrosion resistance and longer operational lifespans, translating to reduced maintenance costs and improved performance across the life cycle of aircraft. The use of these lightweight materials aligns with the broader goals of the aviation industry for sustainability and cost-efficiency, offering airlines substantial savings in fuel costs while meeting environmental regulations.

- Emphasis on maintenance, repair, and overhaul (MRO) services:

Landing gear systems endure high levels of wear due to frequent take-offs, landings, and environmental exposure and require regular servicing to ensure safety and compliance with aviation standards. The increasing air travel frequency and aging fleets that require more comprehensive maintenance solutions are driving the demand for maintenance, repair, and overhaul (MRO) services. To address these needs, the industry is adopting predictive maintenance practices, where advanced sensors and data analytics anticipate maintenance requirements before issues arise. This proactive approach reduces unscheduled downtimes, enhances operational safety, and optimizes maintenance cycles, ultimately adding value for airlines. Additionally, MRO providers and manufacturers are investing in technologies and partnerships to streamline service offerings, making MRO a critical component of commercial aircraft landing gear.

- Advancements in automation and smart landing gear technology:

Technological advancements are enabling the development of smart landing gear systems equipped with sensors and automated functions, which enhance operational reliability and safety. These smart-systems use real-time data from embedded sensors to monitor critical aspects, such as weight distribution, landing impact, and wear levels, providing immediate insights for ground crews and pilots. Automated diagnostics in landing gear not only streamline maintenance processes but also allow airlines to adopt predictive maintenance strategies, minimizing unexpected downtime. Moreover, some advanced systems are capable of self-adjusting based on environmental conditions, including adapting braking pressure on wet or icy runways. The integration of automation and smart technology is transforming landing gear from a purely mechanical component to a sophisticated, data-driven system.

Request for a sample copy of this report: https://www.imarcgroup.com/commercial-aircraft-landing-gear-market/requestsample

Commercial Aircraft Landing Gear Market Report Segmentation:

Breakup By Aircraft Type:

- Narrow-Body

- Wide-Body

- Regional Jet

- Others

Narrow-body exhibits a clear dominance in the market attributed to the high demand for narrow-body aircraft in regional and short-haul flights.

Breakup By Landing Gear Types:

- Main Landing Gear

- Nose Landing Gear

Main landing gear represents the largest segment, as it bears the primary load during takeoff and landing.

Breakup By Arrangement Type:

- Tricycle

- Tandem

- Tailwheel

Tricycle holds the biggest market share owing to the ability of tricycle configuration to provide enhanced stability, ease of landing, and better forward visibility.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the market due to increasing air travel, growing fleet size, and rising investments in aviation infrastructure across the region.

Top Commercial Aircraft Landing Gear Market Leaders:

The commercial aircraft landing gear market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- AAR Corp.

- Circor Aerospace Inc. (Circor International Inc.)

- Collins Aerospace (Raytheon Technologies Corporation)

- Héroux-Devtek Inc.

- Honeywell International Inc.

- Liebherr Group

- Magellan Aerospace Corporation

- Mecaer Aviation Group

- Revima Group

- Safran S.A.

- Sumitomo Precision Products Co. Ltd.

- Triumph Group Inc

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1–631–791–1145